Therapy isn't just about the copay you see on your insurance card

Most people think they know what therapy costs because they see a $30 or $50 copay listed on their insurance plan. But that number is just the tip of the iceberg. If you're paying for therapy over weeks or months, that small copay can add up to thousands - especially if you haven’t met your deductible yet. Many patients are shocked when they get their first bill and realize they owe $125 per session, not $30. Why? Because their insurance hasn’t kicked in yet. Calculating the real cost of therapy means looking past the copay and understanding how your entire insurance plan works.

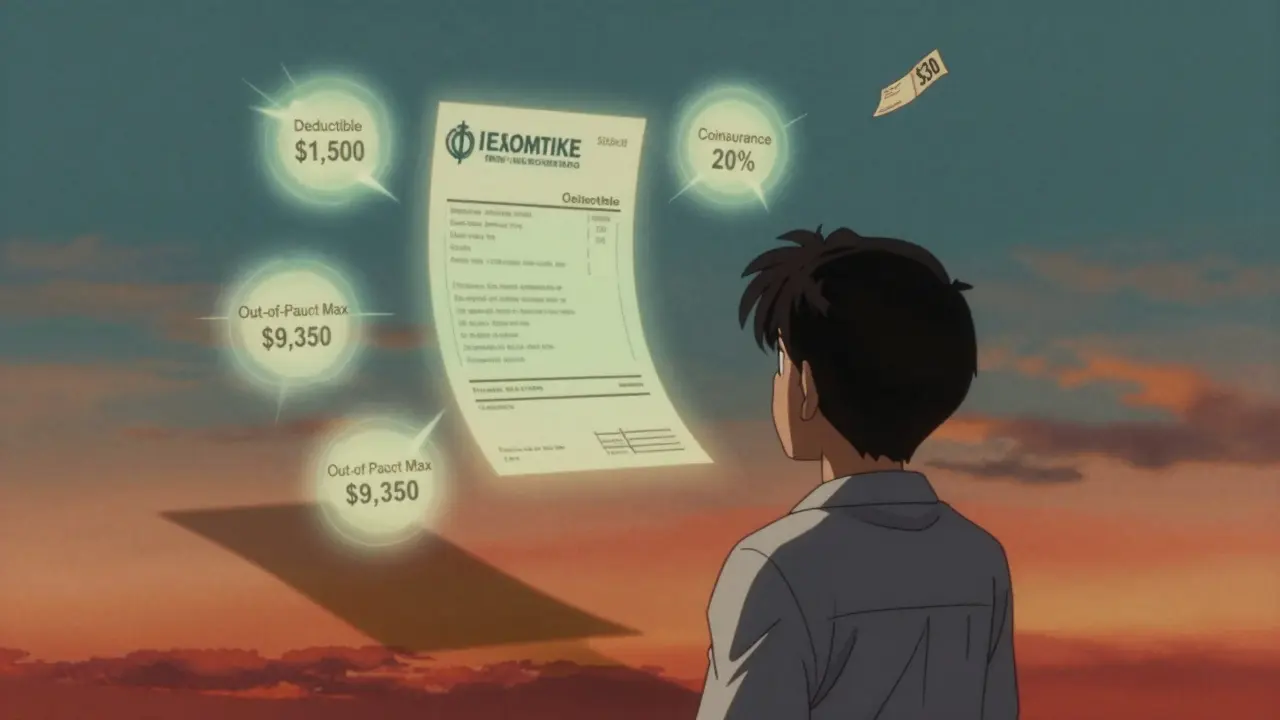

What you’re really paying: deductible, coinsurance, and out-of-pocket max

Your insurance plan doesn’t just have a copay. It has three other big financial pieces: the deductible, coinsurance, and out-of-pocket maximum. These work together to determine how much you pay before insurance covers more. If you’re on a deductible plan, you pay the full cost of each therapy session until you hit your deductible amount. Let’s say your deductible is $1,500 and each session costs $125. That means you’ll pay full price for the first 12 sessions - $1,500 total - before your insurance starts helping. Only then does your copay or coinsurance kick in.

Coinsurance is the next layer. After your deductible is met, you pay a percentage of each session. If your plan has 20% coinsurance, and the therapist charges $125, you pay $25 per session. But here’s the catch: insurance only recognizes a certain amount as the “allowed amount.” If your therapist charges $150 but the insurance allows only $125, you still only pay 20% of $125. You’re not responsible for the extra $25 - unless they’re out-of-network.

Then there’s the out-of-pocket maximum. This is the most you’ll ever pay in a year for covered services. In 2024, the cap for an individual plan is $9,350. Once you hit that, your insurance pays 100% of covered therapy costs for the rest of the year. But here’s what most people miss: this cap includes your deductible, copays, and coinsurance. It doesn’t include your monthly premiums. So if you’re paying $400 a month for insurance, that’s $4,800 on top of your therapy costs.

In-network vs. out-of-network: a huge difference in cost

Choosing an in-network therapist can save you hundreds - or even thousands - over the course of treatment. In-network providers have agreed to accept your insurance’s allowed amount as payment in full. Out-of-network therapists don’t have that agreement. That means you pay the full fee upfront, then submit a claim to your insurance for partial reimbursement. Even then, you might only get back 50% of what you paid.

For example, if an out-of-network therapist charges $200 per session and your insurance allows $125, you’ll pay $200. Your insurance might reimburse you 50% of $125 - so $62.50. That means you’re out $137.50 per session. Compare that to an in-network therapist with a $40 copay after your deductible. You’re paying $40, not $137.50. That’s a 70% savings per session.

And it gets worse. Some plans have separate deductibles for medical and mental health services. So even if you’ve met your $1,500 medical deductible with doctor visits and lab tests, your mental health deductible might still be $1,500. You’re starting from zero again. Always ask your insurer: “Is there a separate mental health deductible?”

How many sessions do you actually need?

Most people assume therapy lasts a few months. But research shows that for moderate to severe anxiety or depression, 12 to 16 sessions are typically needed to see real improvement. For trauma, PTSD, or chronic conditions, 15 to 20 sessions - or more - are common. That’s not a short-term fix. It’s a long-term investment.

Let’s say you’re paying $40 per session after your deductible. If you go weekly for 16 weeks, that’s $640. If you go weekly for a full year (52 weeks), that’s $2,080. Now add in the $1,500 you paid before your deductible was met. That’s $3,580 total. That’s before your monthly premiums. And if you’re on coinsurance? It could be even higher.

Most patients don’t plan for this. They think, “I’ll just pay the copay.” Then they hit session 8 and realize they’re still paying full price. Or they get to session 18 and their out-of-pocket costs are climbing fast. That’s why projecting your total cost over 6 to 12 months matters - not just the next session.

Medicare, Medicaid, and other government plans

If you’re on Medicare, your costs are simpler but still need attention. Medicare covers 80% of therapy costs after you meet your Part B deductible ($240 in 2024). That means you pay 20% of the allowed amount. If the allowed amount is $143, you pay $28.60 per session. But if you want to cover that 20%, you’ll need a Medigap Plan G - which costs $120 to $200 a month extra. So your total monthly cost could be $150 for insurance plus $28 for therapy - $178 per month.

Medicaid is different. In most states, therapy has little to no copay. But finding a provider who accepts Medicaid can be hard. Many therapists don’t take it because reimbursement rates are low. So even if the cost is low, access isn’t guaranteed.

What if you don’t have insurance?

You’re not alone. Nearly 20% of people seeking therapy are uninsured. But therapy doesn’t have to be $150+ per session. Many private therapists offer sliding scale fees based on income. Thriveworks reports that 42% of private practice therapists do this. You might pay $60 instead of $143 - or even $40 if your income is low.

Organizations like Open Path Collective connect uninsured people with therapists who charge $40-$70 per session. University training clinics - where graduate students provide therapy under supervision - often charge 50-70% less than private practices. In Durban, for example, the University of KwaZulu-Natal’s psychology clinic offers sessions for as low as $25.

These options require time to find, but they’re real and accessible. Don’t assume therapy is unaffordable just because you don’t have insurance.

How to calculate your total cost: a step-by-step guide

- Find your insurance plan type: Is it copay-only, deductible-based, or coinsurance?

- Check your deductible: How much do you need to pay before insurance helps?

- Confirm your coinsurance rate: Are you paying 20%, 30%, or 40% after the deductible?

- Know your out-of-pocket maximum: What’s the most you’ll pay this year?

- Verify if your plan has a separate mental health deductible.

- Find out if your therapist is in-network or out-of-network.

- Estimate how many sessions you’ll need: 12? 20? 40?

- Calculate your costs in phases:

- Phase 1: Full price until deductible is met

- Phase 2: Copay or coinsurance after deductible

- Phase 3: 100% covered once you hit your out-of-pocket max

- Add your monthly premiums: Multiply by 12 for the year.

- Include extra costs: Transportation, childcare, time off work.

Real example: A ,820 bill - not 0

Here’s what actually happens: Sarah has a $1,500 deductible, $40 copay after that, and 20 sessions planned at $125 each. She thinks she’ll pay $40 x 20 = $800. But she’s wrong.

First 12 sessions: $125 x 12 = $1,500 (deductible met)

Next 8 sessions: $40 x 8 = $320

Total out-of-pocket: $1,820

That’s not $800. That’s $1,820. And that’s before her $400 monthly premium. If she’d chosen an out-of-network therapist who charged $200 per session, she’d have paid $2,500 just to meet her deductible - and still owed coinsurance after that. Her total could have been over $5,000.

Tools to help you track your costs

You don’t have to do this alone. Most insurance companies have online portals where you can check your deductible progress, copay amounts, and allowed fees. Alma’s free cost estimator lets you plug in your plan and therapist to see your exact projected costs. Rula’s tool shows average session costs based on your zip code and insurance.

GoodRx also has a mental health cost tracker that compares prices between in-network and out-of-network providers. And if you’re on Medicare, the Medicare.gov website lets you search for therapists who accept Medicare and see your estimated costs.

What to do next

Call your insurance provider right now. Ask: “What’s my mental health deductible? What’s my coinsurance? Is there a separate deductible for therapy?” Write down the answers. Then call your therapist’s office and ask: “Are you in-network with my plan? What’s your fee? What’s the allowed amount?”

Don’t wait until you’re in session and get a surprise bill. Plan ahead. Budget like you would for a car payment or rent. Therapy is health care - not a luxury. And you deserve to know exactly what you’re paying.

Frequently Asked Questions

Is the copay the only thing I pay for therapy?

No. The copay is just one part. You might also pay your full deductible before the copay applies, or coinsurance after the deductible is met. You may also pay monthly premiums and out-of-pocket costs if you go to an out-of-network therapist. The copay you see on your card is only the final step - not the full cost.

What if I haven’t met my deductible yet?

You pay the full session fee until your deductible is met. For example, if your deductible is $1,500 and each session costs $125, you’ll pay $125 for the first 12 sessions. Only after that does your copay or coinsurance start. Many people assume insurance helps right away - it doesn’t.

Can I use my medical deductible for therapy?

It depends. Some plans combine medical and mental health deductibles. Others keep them separate. If they’re separate, paying for a doctor’s visit or MRI won’t help you meet your therapy deductible. Always ask your insurer if mental health has its own deductible.

Does out-of-network therapy cost more?

Yes - often much more. Out-of-network therapists don’t have contracts with your insurer, so you pay the full fee upfront. Your insurance might reimburse you 50-60% of the allowed amount, not the full fee. You could end up paying $150 per session instead of $40. In-network is almost always cheaper.

What’s the out-of-pocket maximum for therapy?

In 2024, the federal out-of-pocket maximum for individual plans is $9,350. This includes all deductibles, copays, and coinsurance for covered services - including therapy. Once you hit this amount, your insurance pays 100% of therapy costs for the rest of the year. But remember: this doesn’t include your monthly premiums.

Can I reduce therapy costs if I’m uninsured?

Yes. Many therapists offer sliding scale fees based on income - often 30-50% off. Open Path Collective offers sessions for $40-$70. University training clinics, staffed by supervised students, charge 50-70% less than private practices. These options are real and widely available, even in smaller cities.

Bryan Wolfe

12 January, 2026 22:30 PMThis is the kind of info everyone needs to hear before starting therapy. I wish I knew this when I started last year. That $30 copay lie is everywhere. You think you're saving money and then boom - $1,800 bill. I'm still paying off that surprise. Don't wait like I did.

Rinky Tandon

14 January, 2026 10:57 AMI can't believe people still don't get this. It's not rocket science. You have a deductible? Then you pay. Full stop. But nooo, everyone thinks insurance is a magic wand that covers everything. I've had clients cry because they thought their $40 copay meant they were 'covered'. Wake up. Therapy is expensive. Deal with it.

Monica Puglia

15 January, 2026 13:55 PMI'm so glad someone broke this down. 🙏 I'm on a sliding scale at $50/session because of my income - but I didn't even know about separate mental health deductibles until I read this. My therapist said 'it's just like your doctor' and I believed them. 😅 Now I'm calling my insurer tomorrow. Thank you for the clarity.

Christina Widodo

15 January, 2026 21:57 PMWait so if I have a $1500 deductible and my sessions are $125, I pay full price for 12 sessions? That’s like $1500 just to start paying the copay? I’m broke. I think I’ll just wait until I can afford the full cost. No way I’m taking on that debt.

Audu ikhlas

16 January, 2026 22:09 PMThis is why Nigeria needs better healthcare policies. Here, therapy is either $200 or free at public hospitals - if you can find one. No insurance system. No deductibles. No coinsurance. Just pay or suffer. This American complexity is absurd. You pay for a system that doesn't even tell you the price upfront? Madness.

Sumit Sharma

17 January, 2026 18:34 PMThe structural inefficiencies in U.S. mental health financing are a direct consequence of market-driven healthcare commodification. The deductible/coinsurance paradigm incentivizes provider overbilling and patient financial toxicity. Furthermore, the absence of standardized reimbursement frameworks across payers exacerbates asymmetrical information asymmetry, rendering cost projection non-trivial for the layperson. One must engage in actuarial literacy just to access basic care. This is not healthcare - it's financial warfare.

Craig Wright

19 January, 2026 07:50 AMI find it extraordinary that Americans are so shocked by the cost of therapy. In the UK, we have the NHS. If you need it, you get it. No forms. No deductibles. No surprise bills. You don't 'budget' for mental health like it's a gym membership. You just... go. This entire system is a disgrace. And yet, you still think it's 'the best in the world'.

Cecelia Alta

19 January, 2026 13:50 PMI'm so tired of this. Everyone's like 'oh just call your insurance' like that's easy. I called my insurance three times. Each time I got a different answer. One rep said my mental health deductible was $1500. The next said it was $0 because it's bundled. The third said 'we don't track that, ask your therapist.' I'm not a financial analyst. I just want to feel better. Why is this so hard? Why is my mental health a puzzle?

Jay Powers

20 January, 2026 14:38 PMI’m not even mad. I’m just impressed. This post broke down something I’ve been confused about for 2 years. I thought my $25 copay meant I was done paying. Turns out I paid $1200 before my deductible was met. I’m going to use the Alma tool now. Thank you. This is the kind of post that actually helps.

Lelia Battle

21 January, 2026 04:03 AMThere’s a quiet violence in how we normalize financial barriers to mental health. We call it ‘insurance literacy’ - as if the burden of decoding opaque systems should fall on the traumatized, the anxious, the depressed. It’s not a gap in knowledge. It’s a design flaw. A system that requires you to be financially savvy to access care is not a system of care. It’s a system of exclusion.

Lauren Warner

21 January, 2026 20:51 PMPeople act like this is new information. It’s not. It’s been documented for decades. The fact that you’re shocked means you never bothered to read your policy. You trusted the salesperson. You trusted the therapist. You trusted the myth. Now you’re surprised? This isn’t a failure of the system. It’s a failure of your own due diligence.

Eileen Reilly

22 January, 2026 01:38 AMI found a therapist on Open Path for $60 and I'm so grateful but honestly I feel guilty. Like I'm getting a discount because I'm poor and they're doing me a favor. Why should therapy be this hard to afford? Why do we make people feel lucky just to get help?

Ben Kono

22 January, 2026 07:37 AMI paid $2000 last year for therapy and I still don't know if I met my deductible or not. My insurance portal is a nightmare. I think I did but I'm not sure. I just stopped going because I didn't want to find out I owed more. I'm still in therapy. Just not with anyone who bills insurance. I pay cash now. Easier.

beth cordell

24 January, 2026 05:54 AMI cried reading this. 🥹 I just hit my out-of-pocket max last month. I'm finally at $0 per session. But I've spent $4,200 already. And that's not even counting my $450 monthly premium. I'm not rich. I'm not poor. I'm just tired. Thank you for saying this out loud. I feel less alone now. 💛